Turn on any sports broadcast and it’s hard to avoid ads celebrities telling you, if you are not betting, you are missing out.

From the major sports

To the minor ones, including Czech Table Tennis.

Source: Draftkings Sportsbook

Sportsbooks and their backers want to do everything possible to separate you, from your money.

Is it working?

Yes, too well

Source: Sunday Morning & Siena College Research Institute

The impact?

1 in 5 Gambling Addicts have attempted suicide, the highest among all major addictions.

Source: Sunday Morning & APA

Is it fixable?

At the very least, Congress could ban predatory reload bonuses which prey on addicts

But if people are going to always try to gamble, is there a way that negative behavior could produce a positive outcome at a city, state, and national level?

What if placing a bet on the Super Bowl could help rebuild America’s roads and bridges?

It sounds like a long shot, but its an idea worth considering as the US becomes increasingly addicted to sports betting.

A national sportsbook is not a foreign concept internationally with existing systems in both Asian and Nordic countries.

Here’s how it could work

Uncle Sam the Bookie

Imagine a single, publicly-run platform where Americans everywhere could place legal sports bets, with profits funneled back into the public coffers. This would be a radical shift from today’s state-by-state patchwork of commercial sportsbooks.

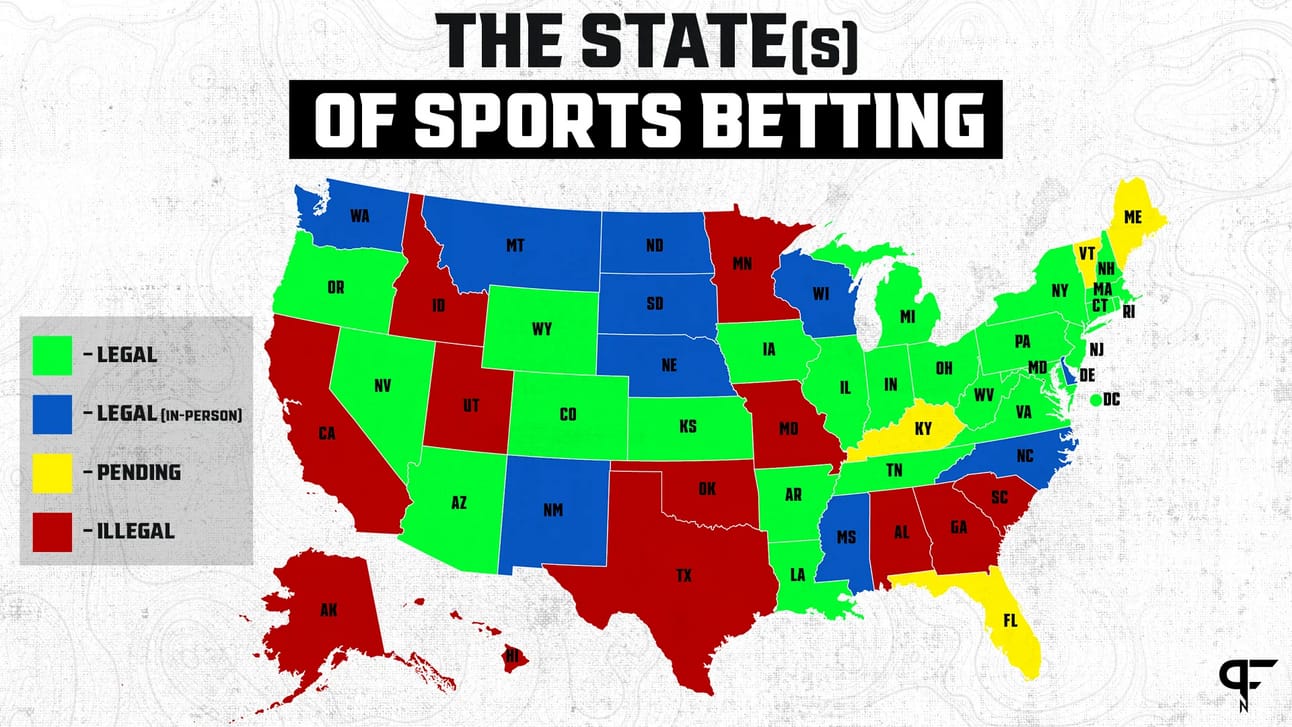

State by State Betting Legalization 2023 - Source: https://www.profootballnetwork.com/where-is-sports-betting-legal-tracking-all-50-states/

The federal government (or a public entity it creates) would hold a monopoly on online sports wagering, much like a national lottery but for sports bets.

All bets would flow through one system, operated for public benefit rather than private profit. Such a system would operate similarly to how state lotteries work. The new online system would offer consistent odds and consumer protections, eliminate the confusing state-by-state restrictions, ban predatory reload bonuses, and capture the full value of the booming sports betting market for taxpayers.

And booming is no exaggeration: in 2023 alone, Americans legally wagered over $100 billion on sports, generating more than $1.8 billion in state tax revenue.

That figure only scratches the surface of total betting profits being made (much of it currently kept by private bookmakers).

Of course, the idea of a national sportsbook is as contentious as it is bold.

Gambling in the U.S. has traditionally been left to the states and tribal nations, and many would balk at federal control.

But, if we set that outside, it’s worth exploring how such a model might work by looking at places that have already taken the house odds into public hands.

Hong Kong’s Betting for Public Good

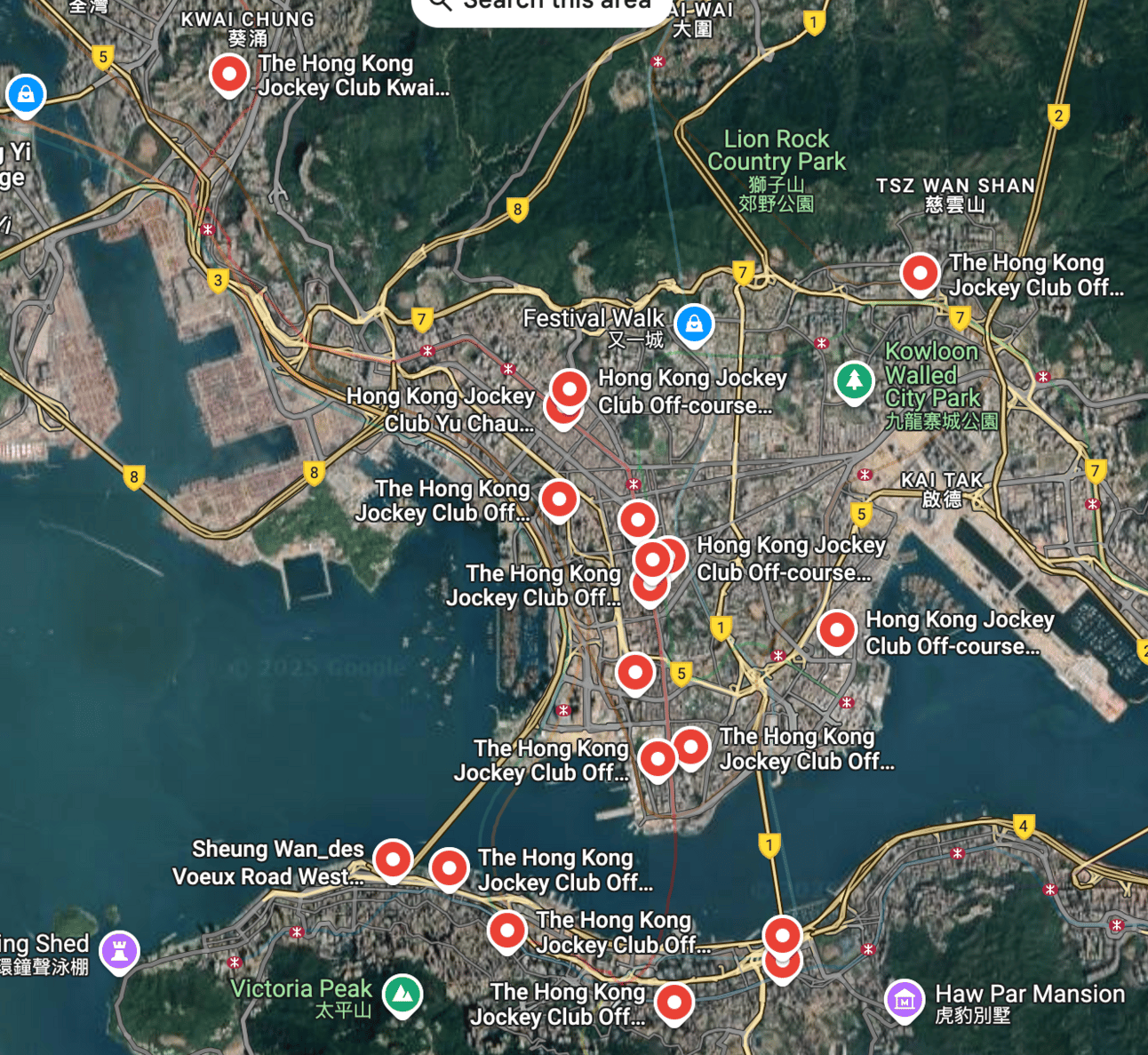

Walk almost anywhere in Hong Kong and you are likely to see two things.

A Hong Kong Jockey Club (HKJC) betting outlet

Betting Outlets - Source: Google Maps

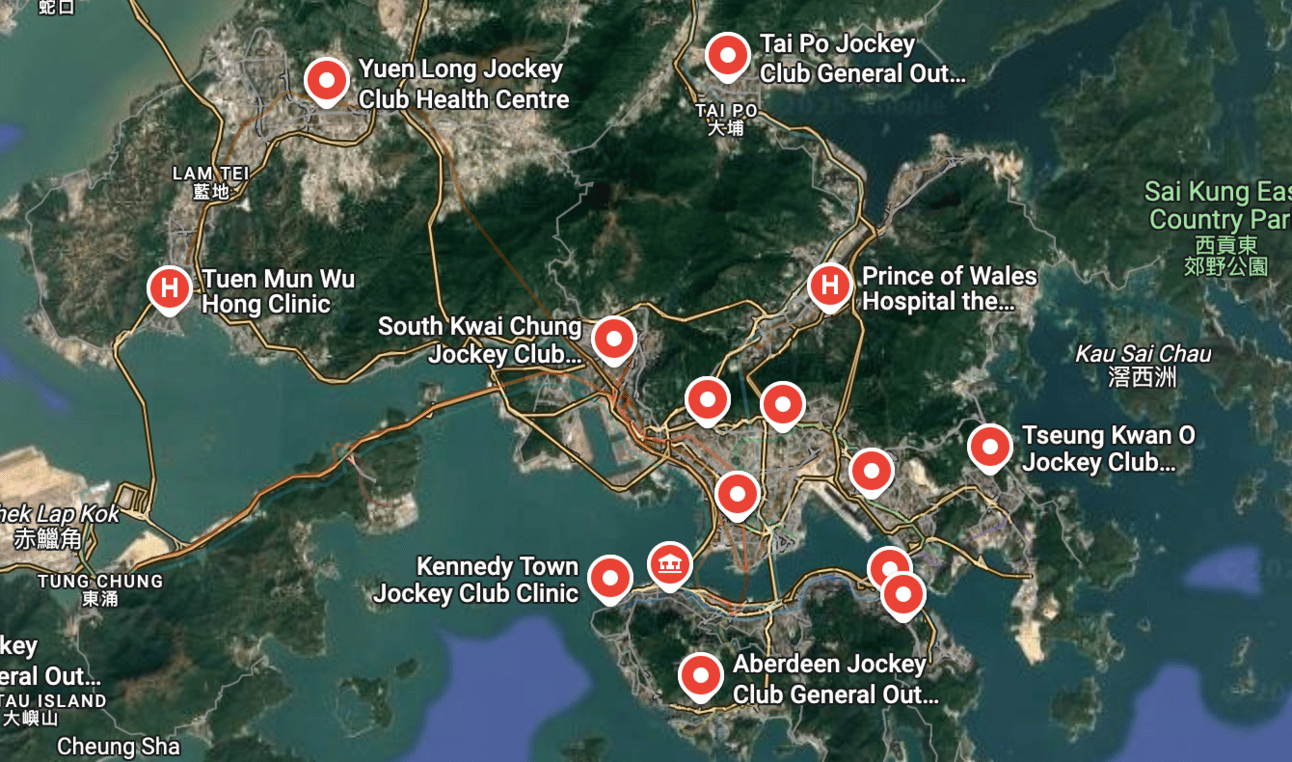

And public instituions emblazoned with a HKJC logo

HKJC Funded Clinics - Source: Google Maps

Example of a Jockey Club Health Center - Source: https://www3.ha.org.hk/tmh/en/patients_visitors/01_12_yl.asp

Hong Kong residents have a nearly insatiable appetite for horse racing and more recently other sports as well. The HKJC is a not-for-profit betting monopoly in Hong Kong. HKJC operates as the only legal provider of horse racing, football (soccer) betting, and lotteries in Hong Kong.

Established in the 19th century, it has evolved into a gambling powerhouse that exists explicitly to funnel wagering proceeds back into the community.

How effectively?

In the 2023/24 fiscal year, the HKJC returned HK$40.1 billion (~US$5.15 billion) to the community, including HK$29.9 billion (~US$3.84 billion) in taxes to the government and HK$10.2 billion (US$1.31 billion) in charitable donations.

HKJC Annual Impact - Source: https://corporate.hkjc.com/corporate/english/history-and-reports/annual-reports.aspx

It employs tens of thousands and maintains a reputation for integrity (helped by the fact that illegal bookmaking is harshly policed to protect the monopoly). While the U.S. is obviously a very different context, the HKJC illustrates the upside of a single, authorized betting entity: huge revenues directed at social betterment rather than into corporate pockets.

HKJC isn’t the only model out there. Some of the happiest countries on Earth have their own versions of public betting systems, too.

The Nordic Model: Finland’s Veikkaus and Norway’s Norsk Tipping

Several Nordic nations have their own state-controlled gambling enterprises. Finland’s Veikkaus Oy and Norway’s Norsk Tipping are prime examples of how government monopoly betting can function in a modern, digital society. Both are wholly owned by their respective states and hold exclusive rights to offer games of chance (from lotteries to sports wagers). The ethos is similar to Hong Kong’s: keep gambling limited, transparent, and beneficial to society.

By law, the profits from Veikkaus have supported areas like culture, arts, sports, science, education, social welfare, health, and even the equine industry.

It is worth noting that that Finland is now debating ending the monopoly in favor of licensing foreign operators, due to half of online gambling spend currently going to offshore sites.

Norway’s system is similarly structured. Norsk Tipping, the state-run betting and lottery company, channels all its profits to public causes by a fixed formula. Remarkably, 64% of Norsk Tipping’s profits go to sports initiatives, 18% to cultural activities, and 18% to social and humanitarian organizations.

Such earmarking of gambling revenue has helped Norway fund athletic facilities and community programs nationwide. The government explicitly uses Norsk Tipping to promote healthy recreation and civil society – all while keeping tight control on gambling to mitigate addiction issues.

The Legal Landscape of U.S. Sports Betting

The United States’ approach to sports betting has done a complete 180 in the past few years. In 2018, the Supreme Court famously struck down the Professional and Amateur Sports Protection Act (PASPA) in the landmark Murphy v. NCAA decision, freeing states to legalize and regulate sports betting on their own.

Since that ruling, 38 states (plus D.C.) have jumped in to allow sports wagering in some form, and about 30 of those even permit online/mobile betting right from your phone.

Sports betting has gone from taboo to mainstream in America virtually overnight with each state charting its own course. This “wild west” expansion has created a fragmented legal patchwork. Every state has its own rules, tax rates, and licensing regimes.

If you travel from New Jersey to Pennsylvania to Ohio, the app on your phone might need to switch to a different operator or shut off entirely if that operator isn’t licensed in the new state.

Tax rates on sports betting revenue vary wildly – from as low as about 6-7% in Iowa or Nevada to a whopping 51% in New York and New Hampshire.

A federally run online sportsbook would represent a massive centralization of an industry that, right now, is as decentralized as it gets. To even attempt it, Congress would have to pass new legislation overriding the current state-by-state framework – essentially preempting state gambling laws in favor of a single federal scheme. A national betting platform would need clear carve-outs to operate.

What about DraftKings and FanDuel, who have spent years and millions lobbying for state licenses? They would likely fight tooth and nail against a government-run competitor that could put them out of business.

The alternative?

America allows these private operators to continue cultivating new addicts while America reaps limited benefits.

In short, the status quo in the U.S. favors a fragmented, commercially driven system, and any move to federalize online betting faces a gauntlet of legal and lobbying challenges.

Yet, it’s not unimaginable. The federal government could assert a national interest, starting with standardizing consumer protections or addressing interstate competition issues.

In fact, some lawmakers have already floated ideas for federal oversight: the proposed SAFE Bet Act would create a federal framework for online betting regulations, requiring states to meet certain standards and focusing on consumer safety measures.

These current efforts aim at regulation rather than nationalization, but they indicate a growing recognition that a purely patchwork approach has drawbacks.

If public sentiment ever shifted to viewing sports betting as a public utility rather than a commercial product, the legal pathway, while difficult, is there.

The Infrastructure Jackpot

Let’s talk money.

What’s in it for the public if America did nationalize online sports betting?

I propose a “80/20 model”: 80% of betting revenue stays within the state where the bet was placed, and 20% goes into a national pool earmarked for federal infrastructure projects.

This hybrid approach aims to give states a big cut, reducing the fear of their revenue streams being hijacked, while still skimming a significant share for Uncle Sam to spend on highways, bridges, and broadband internet.

Why infrastructure?

The American Society of Civil Engineers routinely scores U.S. infrastructure around a mediocre “C” grade and cites a 10-year funding gap of roughly $2.6 trillion to get everything up to snuff.

That’s a huge hole in America’s budgets for roads, transit, water systems, and more.

A national sports betting pool could help fill it without raising traditional taxes.

Betting becomes a voluntary tax where instead of begrudgingly paying the IRS, millions of bettors would contribute via their sportsbook losses, and get some entertainment value in the process.

How much money are we really talking about?

Let’s do a back-of-the-napkin play.

In fiscal 2023, states collected ~$1.8 billion in sports betting taxes, which typically represent only a fraction of the operators’ gross revenue.

If a national entity replaced private sportsbooks, the total gross gaming revenue (the “hold” from all bets after payouts) would accrue to the public.

In 2023, that gross revenue was around $10 billion across all states. And as the market matures, it’s climbing higher each year.

Under an 80/20 split, $8 billion might stay at the state/local level (to fund schools, local infrastructure, etc., as each state sees fit) and $2 billion could funnel to Washington for national projects.

$2 billion annually won’t single-handedly close a trillions-sized infrastructure gap, but its enough to modernize a portion of Amtrak’s rail lines or fund hundreds of smaller projects nationwide.

Crucially, this model tries to balance national interests with federalist sensibilities. States would effectively still “own” the majority of the revenue generated by their residents’ betting (similar to how state lotteries fund state programs today), which could make them more receptive to a federal scheme.

Meanwhile, the federal slice would create a new funding stream for large-scale initiatives that no single state can tackle alone.

Skeptics, of course, would question whether gambling dollars should be relied on for core infrastructure to begin with, after all gambling revenue can be volatile. But as a supplemental source, it’s hard to overlook the appeal of a “Bet on America” infrastructure fund that grows every time someone places a wager on their favorite team. For transparency and public buy-in, such a system would need rock-solid trust.

That’s where a public blockchain could play a role in keeping the house honest.

Transparency & Trust

With many government programs, a frequent question is, “Where is the money”?

A new national betting platform would handle billions of transactions: every bet, every payout, every dollar earmarked for public funds.

How do we know the government-run “house” isn’t cooking the books or mishandling our betting revenue?

By leveraging blockchain technology.

The entire betting ledger could be made immutable and transparent, providing an open audit trail of wagers and outcomes. In a blockchain-based system, every bet could be recorded on a tamper-proof ledger that stakeholders (including regulators and the public) can verify.

This means that once a game’s result is in and winnings are allocated, those records are locked in and visible. Then the allocation of the state’s and federal government’s revenue would also occur on-chain.

Additionally, smart contracts (self-executing code on a blockchain) could automate payouts the instant a match result is final, eliminating delays and reducing human error.

In the context of a national sportsbook, blockchain could ensure the government is playing fair as the house, a critical factor for public acceptance. Beyond fairness, a blockchain-based system could enhance efficiency.

It can streamline compliance checks, as regulators could monitor the ledger for irregular betting patterns or fraud in real-time. It might also lower operational costs by reducing the need for third-party auditors or complex accounting reconciliation, the ledger is the audit.

One can even imagine issuing payouts or revenue shares (the 80/20 splits) via a blockchain token or digital voucher for each state, making the flow of funds instantly trackable and harder to misdirect.

To keep it realistic, I should note blockchain is not a cure-all. It introduces its own challenges (scaling, privacy concerns, cybersecurity).

But conceptually, it aligns well with the need for extreme transparency in a national betting scheme. If Americans are to trust a single, central betting operator, giving them constant visibility into the system’s workings could ease fears of corruption or manipulation.

Tribal and Casino Wild Cards

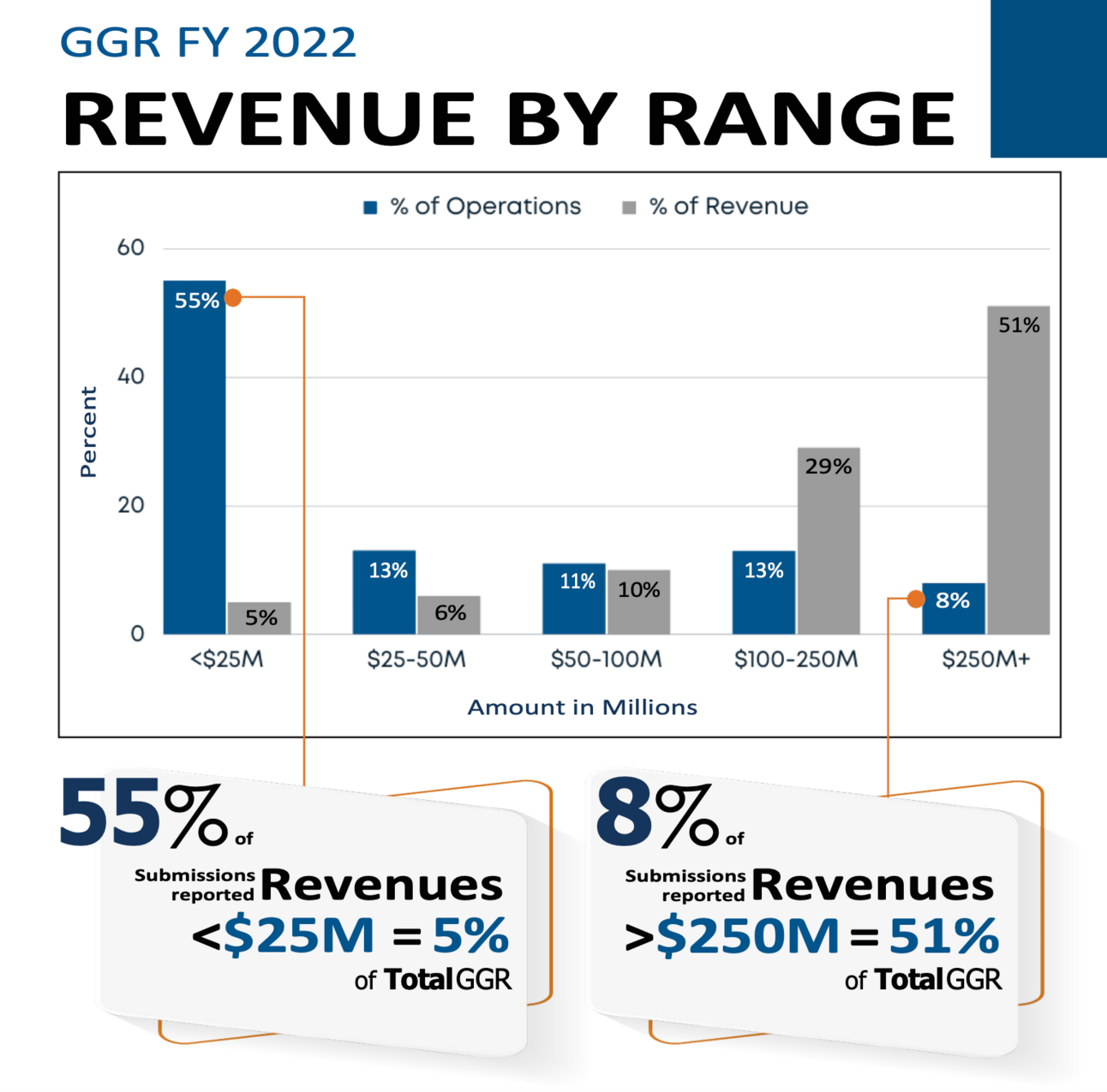

National Indian Gaming Revenue Source: https://www.nigc.gov/images/uploads/reports/GGRFY22_071923_RevbyRange_Final.pdf

No discussion of U.S. gambling is complete without also acknowledging Native American tribes and commercial casinos. Any move toward a nationalized online betting system would have to navigate these interests carefully.

Tribal casinos operate in dozens of states under tribal sovereignty and compacts that often grant them exclusive rights to certain forms of gambling. In fact, tribes generate about 45% of all U.S. gaming revenue,~$41 billion in 2022, from over 500 tribally-owned casinos across 29 states. These casinos are not just businesses; they are lifelines for tribal governments, funding essential services for their communities.

If the federal government launched a competing national online sportsbook, tribes could see it as encroachment on their economic turf, especially if it diverts gamblers away from tribal sportsbooks or casinos.

In states like Florida, the Seminole Tribe fought for (and won) exclusive statewide rights to online sports betting, effectively securing a monopoly via a compact with the state. Any national system would have to contend with such arrangements.

One approach to include tribes as partners, not competitors.

This partnership would involve compensate tribes via routing a portion of a state’s revenue under the new system directly to the tribes.

These are delicate negotiations, but history shows that when big gambling changes happen, tribes are often accommodated. When states started lotteries, many gave tribes the right to operate casinos as a trade-off, and when sports betting came online, some states gave tribes first crack at licenses or revenue-sharing deals.

Native Lights Casino in Oklahoma - Source: https://www.casino.org/blog/10-things-you-should-know-about-native-american-casinos/

Commercial casinos and sportsbook operators are another wild card.

Las Vegas behemoths and online sportsbook companies have invested heavily in their brands and technology. They would likely lobby hard against a public takeover of the market.

To mitigate this, one could envision a model where existing operators become contractors or licensees of the national system, rather than being completely cut out. For example, the national sportsbook might allow sub-licenses for local operations: a casino in New Jersey could operate the national platform’s retail outlet.

This would be akin to how state lotteries sometimes hire private companies to run day-to-day operations behind the scenes, even though the state controls the game.

For in-person betting at casinos, the national model might leave that realm largely to existing casinos and tribal venues, to avoid undermining their foot traffic. The government could focus solely on online betting, and explicitly not offer physical sportsbooks, thereby preserving a niche for casinos.

In return, casinos might agree to integrate their betting systems with the national one (so that odds and payouts are the same, and a bet at a casino ultimately goes into the national pool).

Tribes and casinos could also be given priority or exclusivity in marketing the national platform in their regions, effectively making them affiliates of the public system.

The bottom line is, any federal move here must “cut in” the current stakeholders in some fashion.

Otherwise, the political blowback would be enormous. States, tribes, and casinos would all need to feel they’re getting a fair deal for a national sportsbook to get off the ground.

Is Federalization Worth the Gamble?

Given all these moving pieces, is a nationalized online sports betting system a brilliant idea or a fool’s errand?

The answer might be “both.”

It’s undeniably a long shot, faced with daunting legal barriers and entrenched interests.

The U.S. has a deep tradition of federalism in gambling, from Nevada’s casinos to Native American gaming compacts, betting has always been a local affair.

Reversing that in favor of a Washington-run operation would be politically explosive.

Critics would raise concerns about government overreach, moral qualms about the feds profiting from gambling, and skepticism over whether the promised public benefits would truly materialize.

Yet, the potential rewards are massive.

A national system could mean stronger oversight and uniform consumer protections across all 50 states – no more inconsistent rules on minimum age, advertising, or responsible gambling measures.

The regulatory consistency could help address issues like problem gambling with nationwide programs rather than a patchwork of state efforts.

It could also enhance sports integrity: with one centralized book, it’s easier to spot suspicious betting patterns that might indicate match-fixing and to coordinate responses.

Financially, the idea of transforming an exploding billion-dollar industry into a public revenue engine is alluring. We’ve seen how other countries have used gambling monopolies to fund social goods, and the thought of American sports betting helping to bankroll everything from new airports to high-speed internet in rural areas is exciting.

It’s the kind of big, swing-for-the-fences policy idea that doesn’t come around often.

Essentially, it asks: if people are going to bet anyway, why not have society at large reap the reward?

In the U.S., competition among dozens of sportsbook apps has led to aggressive advertising, promotional free bets, and a race for market share that sometimes seems to outpace responsible practices. A nationalized entity wouldn’t have to compete; it could dial back the marketing frenzy and emphasize moderation.

As a monopoly, it could set lower betting limits or strict loss limits if desired, sacrificing some profit for the sake of protecting consumers, something private companies rarely consider.

CBS News reported existing sportsbooks make 80% of their profits from 15% of people who are gambling the most. Largely preying on people dealing with addiction.

Is it not worth trying to save lives and help improve America?

A national sportsbook is certainly provocative: it challenges us to rethink who should profit from our vices and pastimes.

In a country that once prohibited sports betting nationwide until 2018 and now embraces it state by state, the next evolution might just be bringing the action under one roof.

It’s a long shot bet.

But, if it hits…the payout for America could be a real jackpot.

Thank you to Joaquin and Vito for giving me feedback on this essay.

Support

If you are someone that is suffering from Gambling Addiction, suicide is not the answer.

You can get help.

Here are some resources below and finding more local treatments in your area is only a search away.

National Gambling Hotline - https://www.ncpgambling.org/help-treatment/